kansas city vehicle sales tax calculator

There may be additional sales tax based on the city of purchase or residence. Motor vehicle titling and registration.

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Tax Information entered into the Tax Calculator is not stored or saved on a server or your.

. Taxes Sales Information Sub-menu. There may be additional sales tax based on the city of purchase or residence. Other 2021 sales tax fact for kansas as of 2021 there is 165 out of 659 cities in kansas that charge city sales tax for a ratio of 25038.

This will be collected in the tag office if the vehicle was purchased from an individual or out-of-state car dealer. The 650 state a 145 Finney. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information.

There are also local taxes up to 1 which will vary depending on region. 775 for vehicle over 50000. Or more 5225 Trucks 5225 Motorcycles 2825 Motorized Bicycle 2000 Property Tax.

425 Motor Vehicle Document Fee. You may pay a sales tax the first time you register a new or used vehicle if purchased from an individual or an out of state dealer. The state sales tax rate in Kansas is 65.

Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. Tax Sale ApplicationBidder Registration. For additional information click on the links below.

Or less 4225 Autos 4501 lbs. Calculate By ZIP Codeor manually enter sales tax Kansas QuickFacts. Kansas has a 65 statewide sales tax rate but also has 377 local.

Choose a search method VIN 10 character minimum Make-Model-Year RV Empty Weight And Year. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. The combined state and local sales tax rate in Garden City is 895.

Capital gains in Kansas are taxed as regular income. Kansas Vehicle Property Tax Check - Estimates Only Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year Search By. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. Boards and Commissions Sub-menu. SAFE Senior Tax Refund.

The tax rates used in the Tax Calculator are based on the new 2017 Kansas income tax rates but in some instances approximations may be used. Kansas Sales Tax Calculator You can use our Kansas Sales Tax Calculator to look up sales tax rates in Kansas by address zip code. Subtract these values if any from the sale.

Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. To calculate sales tax visit Kansas Department of Revenue Sales Tax Calculator. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

How much is sales tax on a vehicle. Car tax as listed. Kansas city vehicle sales tax calculator.

For the property tax use our Kansas Vehicle Property Tax Check. A 500 fee will be applied to each transaction handled at any of the tag offices. A 500 fee will be applied to each transaction handled at any of the Tag Offices.

There is no city sale tax for johnson. The sales tax in Sedgwick County is 75 percent InterestPayment Calculator. Vehicle Property Tax Estimator.

The rate in Sedgwick County is 75 percent. You pay tax on the sale price of the unit less any trade-in or rebate. If you have any questions about how Kansas sales and use tax laws apply to your business please visit the departments Policy Information Library on our web site wwwksrevenuegov or call the departments Taxpayer Assistance Center at 1-785-368-8222.

Home Motor Vehicle Sales Tax Calculator. Kansas tax rates are described in terms of mill levies. About WYCO KCK Sub-menu.

Kansas 105 county treasurers handled vehicle registration tags and renewals. Total sales tax percentage collected by Kansas retailers from their customers. Kansas Capital Gains Tax.

You can find these fees further down on the page. 635 for vehicle 50k or less. This is the total of state and county sales tax rates.

Local tax applies whenever a state tax is due if the tax situs for the sale is in a county or city with a local tax with a few exceptions. Tax credits itemized deductions and modifications to income are beyond the scope of the Tax Calculator. 111 s cherry st olathe.

Look up fees to title and register vehicles. Both long- and short-term gains are subject to the income tax rates listed above with a top rate of 570 for 2021. Use this online tool from the kansas department of revenue to help calculate the amount of property tax you will owe on your vehicle.

There may be additional sales tax based on the city of purchase or residence.

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Missouri Car Sales Tax Calculator

Nevada Sales Tax Small Business Guide Truic

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Finding The Right Buy Here Pay Here Car Lot In Kc Auto Bank Kc

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales Tax On Cars And Vehicles In Kansas

Connecticut Sales Tax Calculator Reverse Sales Dremployee

Missouri State Taxes For 2022 Tax Season Forbes Advisor

Car Tax By State Usa Manual Car Sales Tax Calculator

California Vehicle Sales Tax Fees Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Dear Snow Angel In 2021 Camry Toyota Dealers Kansas City Chiefs Logo

Car Tax By State Usa Manual Car Sales Tax Calculator

Dmv Fees By State Usa Manual Car Registration Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

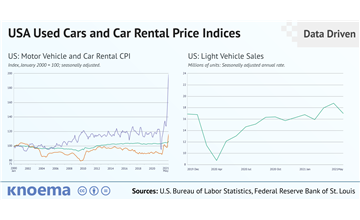

Free Infographics And Data Visualizations On Hot Topics Knoema Com

How Is Tax Liability Calculated Common Tax Questions Answered